Featured

Table of Contents

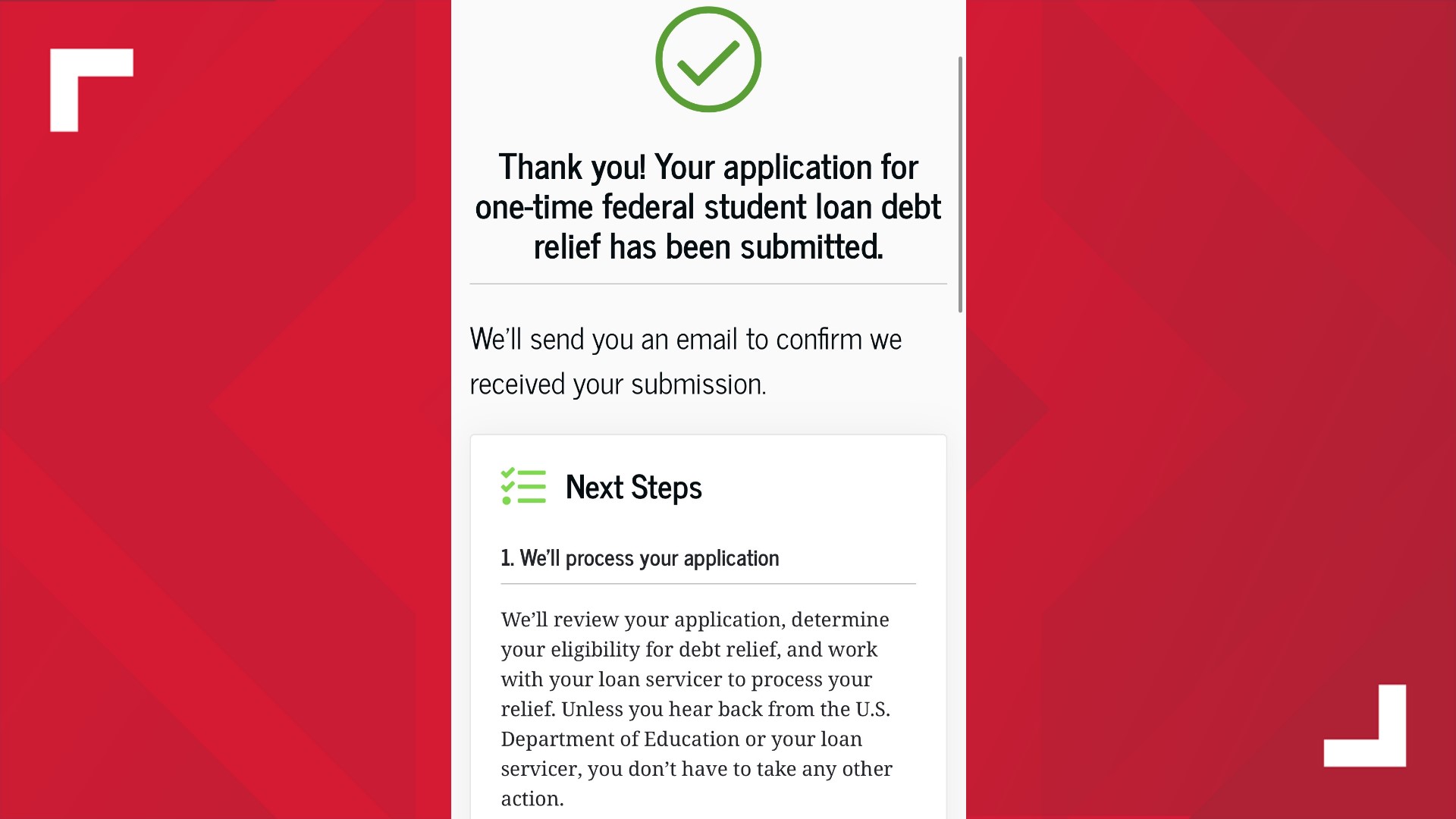

The catch is that not-for-profit Bank card Debt Mercy isn't for everybody. To qualify, you need to not have made a payment on your credit card account, or accounts, for 120-180 days. Additionally, not all lenders get involved, and it's only provided by a few nonprofit credit counseling firms. InCharge Financial debt Solutions is just one of them.

The Credit History Card Mercy Program is for individuals that are so far behind on credit card repayments that they are in major financial difficulty, perhaps encountering insolvency, and don't have the revenue to catch up."The program is especially created to assist customers whose accounts have been charged off," Mostafa Imakhchachen, consumer treatment specialist at InCharge Debt Solutions, stated.

Creditors who take part have agreed with the not-for-profit credit history counseling company to accept 50%-60% of what is owed in taken care of regular monthly settlements over 36 months. The fixed settlements imply you understand exactly how much you'll pay over the settlement period. No interest is billed on the balances throughout the benefit duration, so the repayments and amount owed don't transform.

It does show you're taking an active function in decreasing your financial obligation. Considering that your account was currently means behind and billed off, your credit scores score was already taking a hit. After settlement, the account will be reported as paid with an absolutely no equilibrium, instead of exceptional with a collections company.

The Definitive Guide to Extended Assistance and Group Support

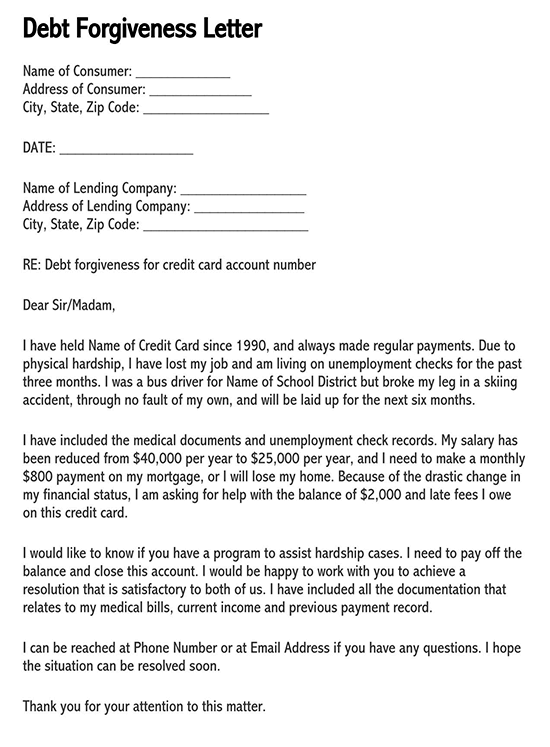

The counselor will certainly review your funds with you to establish if the program is the right choice. The evaluation will consist of a look at your regular monthly revenue and expenditures. The firm will certainly pull a credit history report to understand what you owe and the level of your difficulty. If the forgiveness program is the most effective service, the therapist will certainly send you an arrangement that details the strategy, consisting of the quantity of the monthly repayment.

If you miss a repayment, the contract is squashed, and you must exit the program. If you believe it's a good alternative for you, call a therapist at a not-for-profit credit counseling company like InCharge Financial obligation Solutions, who can answer your questions and assist you figure out if you certify.

Since the program enables consumers to settle for much less than what they owe, the lenders that participate want reassurance that those that make use of it would certainly not have the ability to pay the total. Your charge card accounts also must be from financial institutions and charge card companies that have actually consented to get involved.

Our Rebuilding Personal Financial Standing the Smart Way Statements

If you miss a repayment that's simply one missed repayment the agreement is ended. Your financial institution(s) will cancel the strategy and your equilibrium goes back to the initial amount, minus what you have actually paid while in the program.

With the forgiveness program, the lender can rather pick to maintain your financial debt on guides and redeem 50%-60% of what they are owed. Nonprofit Debt Card Financial obligation Mercy and for-profit financial obligation settlement are comparable in that they both give a way to work out charge card debt by paying less than what is owed.

Bank card mercy is developed to cost the consumer much less, repay the financial debt quicker, and have fewer drawbacks than its for-profit counterpart. Some key areas of difference between Credit report Card Financial debt Mercy and for-profit financial debt negotiation are: Bank card Debt Mercy programs have relationships with creditors who have actually consented to get involved.

The 15-Second Trick For Additional Charges to Avoid

Once they do, the benefit period starts instantly. For-profit debt settlement programs bargain with each lender, typically over a 2-3-year duration, while passion, charges and calls from debt enthusiasts continue. This means a bigger hit on your credit record and credit report, and a raising equilibrium up until arrangement is completed.

Debt Card Financial debt Mercy customers make 36 equivalent monthly settlements to eliminate their debt. For-profit debt settlement clients pay right into an escrow account over an arrangement duration towards a swelling sum that will be paid to creditors.

Latest Posts

The 10-Second Trick For Pricing Honesty to Watch For

The Ultimate Guide To Steps for Contact a Counselor Now

All about State Resources for Financial Assistance